Why Fish Feed Prices Have Reached Record Highs

Fish feed has always been the highest operational cost to a farmer, and depending on the species, it can range anywhere from 50-70% of the total of the production cost to a farmer, meaning that from all the expenses a farmer needs to analyze, feed is always the number 1 priority. And since December of 2021, we’ve seen the commodity price of fishmeal climb steadily almost 30% from $1.4k / metric ton to the last reported price of $1.8k metric ton. This is the result of a few different factors.

The ingredients for feed you can be largely broken down into these 4 categories, proteins, lipids, carbohydrates (starches and sugars), and a combination of fillers, vitamins, and minerals. The first three categories are the ones that drive the majority of the costs behind feed.

In this article we'll talk through each one and analyze the changes that are going on. Depending on the farmed species, the levels of these components will be different, but across the board they are constructed in roughly in the same ratios. These ingredients are sourced from all over the world - salmon and Norway can be fed a combination of soy from Brazil, fish from Peru, krill from Antarctica, and algae from the USA.

Understanding the Effects of Global Events on Animal Feed

What we’ve seen for prices the last couple of years has been the results of an extremely unique combination of global events that are happening all at the same time. In the short term, these events have resulted in the spikes of prices, but the longer term impacts may change how the entire animal feed industry operates all together. The long term supply chain issues from COVID, wars across the global, and climate related impacts are all happening at the same time and causing major disruptions - let us explain.

Let's start with the most expensive and largest component of fish feed - protein. Fishmeal processed from wild caught fish has historically been the main raw ingredient for this category. In recent decades, we’ve also seen plant extracts like soy protein increasingly used as a substitute. Of the major disruptions we’re seeing, soy protein would actually be considered one of the markets that has been disrupted the least, which is almost crazy to say. Compared to the pre-pandemic levels towards the end of 2019, the price per metric ton of soybean meal has risen from $350 to $500 today or 43% increase and the reasons is mostly due to COVID related recovery, as for the most part, the largest producing countries that make up over 80% of global supply, Brazil and the United States, have avoided catastrophic events.

Fish meal, on the other hand, has seen much more disruption, which we'll discuss in the next section, as the source of fish meal, wild fisheries has encountered some extreme challenges.

Understanding the Effects of Global Events on Animal Feed

The second most important component in fish feed is lipids or fats, and omega-3 fatty acids are specifically the lipids we’re interested in. For the same reason that nutritionists recommend humans to eat fish for Omega-3s, fish need to also be fed with omega-3s for the fatty acids to be translated into their muscle fibers. The main source of lipids for fish feed comes from fish oil, which is sourced primarily through wild fisheries. The price of fish oil has literally doubled in the last 2 years from $2000 per metric ton to over $4000 for a massive 100%.

While supply chains for wild fisheries were also impacted by COVID like pretty much every other market, the larger concern here has been the developing challenges with the Peruvian Anchovy market and the cancellation of the largest commercial fishery in the world. Stay with me here, as I found this to be the most interesting facet of my research for this story.

Peruvian Anchovy Fishery Crisis: Effects on Fish Meal Production

The Peruvian anchovy fishery is the largest wild-caught fishery in the world, followed by Alaskan Pollock. This fishery produces roughly 4M metric tons of anchovies each year, and almost all of it is used for products like fish meal. As reported by the FAO, the country historically produces almost half of the world’s supply of fishmeal and a third of the world’s supply of fish oil. But this year, Due to early samples of the fishery and the impacts of one of the strongest El Niños on record, the government decided this summer to cancel the first of 2 fishing seasons. Just like that, one of the country’s largest export markets was turned off.

Fishmeal plants in the country have shut down for the first time in 30 years, and the government has already issued subsidized payouts to help fishermen keep their businesses afloat. The entire country is awaiting a decision for the second season that is scheduled to start in the next month. But from the experts we've spoken to, even if the fishery opens, quotas will likely remain smaller due to the impacts of the El Niño and the impact on fish feed market will still continue to be felt for many months if not years to follow.

The Role of Carbohydrates in Fish Feed and Their Impact on Prices

The last major component of fish feed is carbohydrates or (starches and sugars), and these are considered the least expensive source of energy in fish meal. A unique fact that we found on the topic of carbs is that while carbs are a major source of energy for mammals, the concept of carbo-loading isn’t applicable to fish. For each gram of carbohydrate a human consumes, we can extract 4 calories of energy while fish are only able to extract 1.6 calories. Nevertheless, carbs are still by percentage a major component of feed, and they are used as binding agents and their volumes help to reduce feed costs. Wheat and corn are the major sources of carbs, and the prices for these commodities are still roughly 45% higher than pre-pandemic levels.

Russia and Ukraine are both major global exporters of corn and wheat, and the war in Ukraine, for a short period of time, caused the price per ton for wheat escalated 150% to over $500 per ton. While currently the costs for these carbs have come down from their peak, the impacts of the Ukraine war have already been felt and the price spikes the feed companies have paid will be passed to farmers.

Adapting to High Feed Prices: Strategies for Aquaculture Farmers

So what does this mean to farmers and the industry at large. Well, I see its impact developing in a few different ways, and while the signs may not seem like positive trends, I strongly believe the response and solutions during these challenging times will set the aquaculture industry on a more predictable path for the future.

Unfortunately for farmers, it looks like we’re entering some heavier waters - in the short and mid-term, it’s hard to imagine that any way that feed prices will drop and it’s very likely that prices will actually continue to climb. The havoc created by the market impacts I’ve discussed are just going to take time to sort out, and that equates to the continuation of high prices. Additionally, combining high feed prices with un-predictable consumer demand and variable yields, it is going to be a tough time for farmers in many different regions.

That said, we see two key opportunities coming out of these situations.

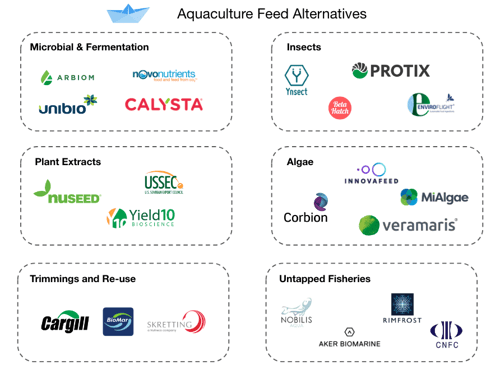

- Innovative companies who have been building alternative replacements to the feed ingredients are having a moment of opportunity.

- Companies have an opportunity to invest in new research and accelerate the science of animal nutrition.

The last time feed prices rose, the industry made the shift to include more soy in fish diets, and now we’re seeing that pattern repeat. Let's walk you through some of the companies that have been working for years to replace parts of the major feed components - they've been raising money, lowering costs, and increasing their scale.

Exploring New Ingredient Alternatives for Aquaculture

First and probably least risky approach is tapping into new fisheries. With modern science and better boats, we’re able to harvest previously untapped species such as Antarctic krill. Companies such as Rimfrost and Aker Biomarine have built commercial fishing fleets capable of producing krill oil and other products. Currently Aker Biomarine is publicly traded with a market cap of 300M dollars. There are obvious concerns of overexploitation and mis-management like we have seen in other international fisheries, but in the short term, it does offer solutions to issues like Peru. Another solution that I’ve personally been fascinated with is the harvesting of invasive species like Asian Carp, which companies like Nobilis have worked on. While the volume of these invasive species are extremely small, I love the idea of finding commercial solutions that improve ecological challenges.

Another category which has started to reach scale is the replacement of fish oil by using microalgae and plant extracts. Both Veramaris and Corbion have commercial scale algae growing facilities that are capable of producing algae oil and a large percentage, somewhere in the neighborhood of 80% of all salmon in Norway are fed with feed that contains algae oil today. On the plant extract front, companies like Yield10 which supply omega-3 oil from genetically modified Camelina plants, are starting the process to get approval to grow commercial scale volumes of their oil extracts.

Learn more about our collaborative research on EPA + DHA with Veramaris

Next-Generation Protein Sources: Bacteria and Insects in Fish Feed

Moving on to the last two categories of protein replacement, we delve into bacterial proteins and the emerging practice of commercial scale insect farming. Companies like Calysta have invested a staggering $200 million in fermentation technology, where microorganisms are fed with outputs like CO2 from power plants to produce bacterial single cell protein. While these solutions have proven their feasibility, they have not yet reached commercial scale quantities, though their factories are currently being set up. Insects, on the other hand, fall into the same category, and we can expect to witness the first commercial scale utilization in the near future. It's a logical concept on paper - we can rear insects and utilize them as replacements for protein and lipids. In fact, just last week, Tyson Foods announced its investment in Protix, an insect company, to jointly establish and operate the first large-scale facility for processing insect protein. This announcement follows closely on the heels of another insect company, Insect with a Y, which recently raised a whopping $175 million in a Series D funding round earlier this spring.

Investing in Research: Enhancing Aquaculture through Nutritional Science

It's crucial to acknowledge the significant influence these groundbreaking innovations will have on propelling the field of animal nutrition forward. In the early stages of fish farming, farmers simply relied on providing fish with their natural diet. However, as time has progressed, the composition of fish feed has undergone a remarkable transformation, driven by various factors such as cost considerations and the expansion of the industry.

Looking ahead, it is undeniable that there will be a surge in the adoption of alternative ingredients in fish feed. And let's not forget about the essential inclusion of vitamins, minerals, and probiotics in modern feeds. The complexity of these formulations will continue to grow, emphasizing the pressing need for further scientific research in the field of animal nutrition. While a new ingredient may show promise in the laboratory, the true challenge lies in successfully implementing it in practical farming settings.

Companies are recognizing this challenge. An example of this can be seen in Cargill’s recent investments in their Feed Innovation Center, located in Dirdal Norway. While it was a small $1.2M investment, it scaled the number of net pens from 3 to 12 to conduct field trials, and that gives Cargill the opportunity to dramatically increase the number of combinations they can commercially field-test at this facility to learn more about what is best to feed our fish.

As scientific advancements continue, we eagerly anticipate the innovations that will help reduce the financial risks associated with fish feed costs for farmers. The aquaculture industry is known for its volatility, but by finding ways to stabilize its highest operating expense, we can foster even greater growth in this market.