The Cost of Sea Lice: A Comprehensive Review

Every year, farmers spend more than $1 billion globally on sea lice treatments, but when you consider the additional impacts downstream, the cost is multiplied several times over. Salmon farming is widely recognized as the most profitable, largest-scale, and technologically advanced form of aquaculture in the world. Originating in Norway in the 1960s, it now accounts for over $30 billion in global exports, with sea lice playing a crucial role in shaping the industry's future.

In this article, we will dive into the profound impact that sea lice have on salmon farmers. Exploring the intricacies of sea lice and the emergence of government regulations worldwide aimed at managing this parasite, we will gain a comprehensive understanding of the challenges faced by the industry. Additionally, we will examine how companies like SolvTrans have successfully adapted to these regulations, bolstering their annual revenues to over $100M by providing invaluable support to farmers in their battle against sea lice. Finally, we will reflect on the implications for farming companies and speculate on the future of sea lice management.

Sea Lice Impact on Salmon Farmers: What are they?

Sea lice are a parasite that exist in the natural ocean environment, and they attach to salmon as a host. As a category, these small and alien-looking copepods are extremely abundant and considered the largest source of protein in the world’s oceans.

Sea lice are a crustacean that attach to both wild and farmed salmon. In farmed conditions, the lice have increased opportunities to reproduce and populations of lice scale exponentially. The large numbers of lice do not necessarily impact the health of the farm fish, but there are environmental concerns on the impact of sea lice on juvenile wild salmon, particularly as they migrate out of the freshwater streams in the springtime.

How Are Sea Lice Regulated?

As a result, all regions that farm salmon globally have developed regulatory frameworks to ensure that farms are managing their sea lice counts appropriately. Most major producing countries - Norway, Canada, Scotland, Chile, all require weekly sampling and reporting to the government. And each country has a different limit for how many lice can be found on each fish during these samplings. Norway was the first to start weekly monitoring, starting in 2012, and we’ve seen the other countries follow-suit in the years following. Most recently, Scotland started weekly reporting in 2021.

As the first and largest producing country, Norway has typically been at the forefront of developing new regulations and technologies to further improve the management of sea lice. In the decade since establishing weekly counts, we’ve seen the lice regulations develop a couple of times.

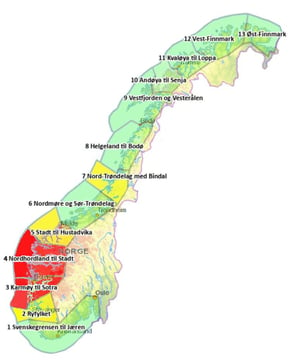

One of those major developments was the establishment of the traffic light system in 2017. The system was developed as a method to improve area management and encourage farmers to work more collaboratively instead of just paying attention at their own farms. Each year, regions are market with a red, yellow or green light, which determines the amount of growth for the region in the following year. If you are in the Green, you are allowed a 6% increase in your biomass license. If you are in the red you have to reduce your biomass by 6%, and if you are in the yellow, you have to maintain your existing permits.

One of those major developments was the establishment of the traffic light system in 2017. The system was developed as a method to improve area management and encourage farmers to work more collaboratively instead of just paying attention at their own farms. Each year, regions are market with a red, yellow or green light, which determines the amount of growth for the region in the following year. If you are in the Green, you are allowed a 6% increase in your biomass license. If you are in the red you have to reduce your biomass by 6%, and if you are in the yellow, you have to maintain your existing permits.

This regulation has had a significant impact for a couple of reasons.

First, it establishes a clear growth pattern for the industry to grow determined by sea lice. Each year, as long as there are more green regions than red, the overall production in Norway should continue to grow.

Second, it put a costly dollar figure on forcing farms to collaborate. 6% biomass may not sound like much. But when you compound that value over a couple of years as well as accounting for the fact that farms are typically able to harvest more than their biomass limit, each farm is losing millions of dollars each year that their region is in the red.

Reviewing the Aquaculture Industry’s Response

With these regulations in place and the economic impact that sea lice have for farms, farmers have responded by placing a ton of focus on addressing sea lice and making sure their farms stay within regulatory bounds. The results have turned sea lice management into a major operational and strategic focus for farming businesses.

In order to maintain lower lice levels, we’ve seen the growth and development of an entire supporting market of companies that have developed businesses specific to supporting farms in their fight against sea lice.

The Innovative Traffic Light System for Sea Lice in Norway

Lets continue take a look specifically at Norway and the response following the Traffic Light System.

Since 2017, the Norwegian coastline has been divided into 13 different regions, and as previously mentioned, each zone is assigned a red, yellow, or green light that dictates the limits for growth. In the following years, the Ministry of Trade and Industry has reassigned the zoning colors twice, in 2020 and 2022, each time with 2 red zones. Of those zones, production area 4 the western coast has seen their biomass reduce twice for a total of 12%.

As a response, we mentioned that the entire farming and supporting industry has quickly jumped into action to address the situation. Farmers have a combination of different options to remove lice or maintain lower numbers. Categorically you can split these options into preventative and reactive treatments. Preventative treatments such as sea lice skirts, cleaner fish, in-feed solutions, or even lasers that shoot lice are aimed to protect fish welfare while offering lice reduction over a period of time.

On the other hand, reactive treatments which can be categorized into bath and mechanical treatments, offer farmers options to remove large numbers of lice at once. They typically involve pumping the fish into large well-boats and administering medicinal, fresh water, or heated water treatments to kill the lice attached to salmon.

Of all sea lice companies, no one has seen a bigger change to their business since 2017 than perhaps the well boat companies, who provide the vessels to move fish and administer treatments. Solvtrans has become one of the most profitable and largest companies in this space and has seen their revenues grow to above $100M dollars in recent years, an over 50% growth since the traffic light system was initiate.

They manage a fleet of wellboats that service the industry and today their fleet contains 42 vessels. 28 of them, or over 65% of their current fleet, has been built since the creation of the traffic light system. Business has been growing so well that CEO of Sølvtrans, Roger Halsbakk, stated in 2020 that the company would invest an additional 8 billion NOK or the equivalent of 1/2 a billion dollars to build an additional 20 boats over the next 5 years.

Now the boats used in these mechanical treatments are massive and extremely impressive vessels. Many of these boats are over 60M long and are easily some of the largest boats you will see at a port. The average cost to build these vessels in recent years have ranged between 30 and 40M dollars. The cost to operate the boat can go a high as a $100k per day, and many well boat companies are still overbooked.

The Ronja Azul is the 34th new-build that Aas Mek has supplied to Sølvtrans, which operates in Norway, Scotland, Canada, Tasmania. Photo: Aas Mek.

So what has the impact been for the sea lice? Well the easy number to measure is just the increase in treatments. Over a period from 2016 to 2020, there was an almost 300% increase in the number of mechanical sea lice treatments across Norway as farmers began to order more and more treatments. Today we see almost 3000 treatments performed annually and this has led to big changes in reported sea lice values.

Regions 3, 4, and 5, all of which have been given a red light designation, have seen the most significant decrease in average sea lice numbers with PO4, a region just north of Bergen on the west coast of Norway, leading the way with a 35% reduction between the years 2017-2023.

The availability and scale of the well-boat fleet in Norway could be credited with giving the farmers an ample supply of vessels to perform the number of treatments needed to meet government regulations.

In other regions of the world, we haven’t see the mass availability of these vessels or variety of treatment tools yet.

That said, given the pattern exemplified by Norway and the pattern to adopt similar methods, its safe to say that we’ll see a similar pattern of pressure to improve lice treatments and the follow-on expansion of service companies working in the areas.

But while the progress against lice has been good, the impact on fish health has been going in the other direction. The regions in red, where treatments per farm are higher than other regions, reported mortality rates in regions 3,4, and 5, are over 5% higher than other regions. In Production Area 4, the area that has been in Red the last 4 years. They have reported a mortality increase of 8% from 15 to 23%. That means that roughly 1 fish out of every 4 released into a netpen will not make it to harvest.

For the salmon farming companies this combination of an increase in treatments, a decrease in fish health, and a restriction to farm less has a significant impact on the economics for the business. Grieg Seafood, one of the largest publicly traded companies that operates primarily in the red zones has seen their cost to produce fish rise 12.2 nok / kg of fish harvests or an increase of over 34% in the last 4 years. As a result, you’ve seen them make some of the largest investments to limit how much time a fish needs to be raised in the ocean - a direct response to needing to decrease the number of sea lice treatments they perform.

What Does the Future Look Like?

Looking forward, there does not seem to be a path where sea lice does not continue to dominate the topic of conversation driving the policy for salmon net pen production globally and the costs associated with the parasite will continue to be a growing cost for the industry. From all the signs from regulators, there will be a continued evaluation and further development of sea lice regulations.

In the last few months, we’ve already seen plenty of activity in what the next phase of regulation may look like in Norway. With another traffic light designation happening at the end of the year, the industry by and large have raised criticism over the process behind how the traffic light system decides what color a zone should be. Currently, wild salmon migrations are only a metric used to measure lice pressure, and many in the industry feel that one determination is too short sighted.

There’s also an increasing spotlight being placed on the welfare of the animals given the challenges we see with mortality rates at farms. In order for aquaculture to succeed, the welfare of animals and mortality rates will also need to come down.

Just this last week a report was presented from a committee assigned by the Norwegian government to evaluate the current lice situation and balance with fish health. One of the proposals talks about removing the penalty of Red Zones reductions and instead introducing a lice tax on the number of lice that exceed the limits to give farmers more options to maintain fish health. If a farm needs a treatment, but can’t perform one due to fish health concerns, they can instead pay a fee. This proposals have just been introduced, but it serves as an example into the development of potential future sea lice regulations that will continue to push the industry forward.

No matter how you look at the problem, sea lice will continue to be a growing concern for farmers, politicians, and supporting companies to pay attention to.